Credit Reports | Mortgage Broker in Ontario

Actively managing your credit report is mandatory in 2017 (and beyond). Especially if mortgages are in your future – or present.

Establishing and maintaining a good credit report and credit score is pretty simple. There is, however, a lot of mis-information in the market. Today we’ll talk about how it’s used by mortgage lenders, how to optimize your credit score, where you can check and monitor your own report and some of the mistaken beliefs in the market.

Mortgage Lenders Use Credit Reports in several ways.

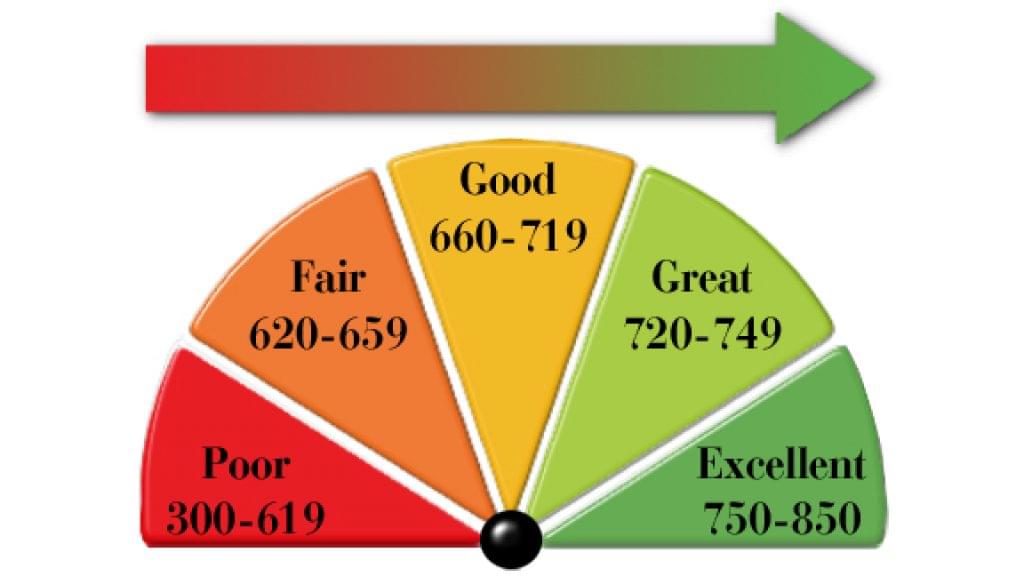

First, there are minimum required credit scores. In practice, both the federal government and lenders require a minimum credit score of 620 or better when you have less than 20% down payment. Higher scores are better. The graphic shows general ranges of what is considered good or bruised. Lenders automatically decline the application if scores are below the required minimum. This is a black and white decision.

Some lenders will allow the co-borrower – not the primary applicant – the one with the majority of the income – to be in the 600-620 range – but below that, they either won’t allow that person’s income to be used in qualifying for the mortgage. Or, they may not even allow that person to be on title or the mortgage at all.

If you are self-employed and trying to use a more flexible mortgage product, then you need to have your score much higher – say 680+

If you want to optimize the amount you can borrow, then you absolutely need your score at 680 or higher.

Note – the amount you can borrow in a mortgage is based on the ratio of your debt payments to your gross income. It is a higher ratio when your credit score is stronger/higher – so you can qualify to borrow more. That might not be an issue right now – but if you buy a more modest home now – and then seek to move up into another house – and either you want to keep the first house as a rental and/or you haven’t sold your first house before buying the second house, you may need to stretch your income as far as possible. Credit scores matter until they are above the 680 threshold.

Once we get past the credit score, then the lender is looking at the type of credit you have, how long you have had it, how much you are borrowing compared to the limit and what your repayment history has been. Late payments are recorded and continue to be for several years.

Improving Your Credit Score and Report

To improve your credit score, we’ll start by understanding how it is calculated.

About a third of the score reflects how you use your credit. The scoring algorithm compares how much you owe compared to the credit limit on cards and lines of credit. It does that by account and across all of your accounts. It looks to see if any accounts are over limit.

Another third is related to how you pay your credit. Do you make minimum payments or pay more. Do you miss payments. Is it one payment late or multiple payments in a row. Are late payments in one account or over several accounts. Are missed payments recent, in the distant past or is their a pattern of consistently missed payments over a longer time frame.

The remaining third deals with everything else, including how many credit checks have been made, address changes, new credit added, collections or judgements and so on.

Everything is time-weighted so the more current or recent the event, the more influence it has on the scoring algorithm.

Yes, this is simplistic, but you get the idea.

Understanding that, how you do manage and enhance your credit report and score?

A lender wants to see at least two types of credit, that has been in place for at least two years, with a combined limit of at least $5k. A single card at $3500 limit with a couple year history can be fine if there are no negatives elsewhere on the report. So, what do you do to make a strong report?

Make all payments on time or early. You have to get really focused on ensuring no payments are late – especially if there is a pattern in history where that has happened.

If you carry a balance on a credit card or line of credit, then keep it at less than half the authorized limit. When you borrow more than half the limit, it will put downward pressure on your score. Pay your cards out in full as often as possible.

Don’t go to every consumer credit place in town and apply for a credit card in the next week – this suggests to the algorithm that you are hunting for debt – which is a red flag – and you score will plunge until there is more information to go by.

If there is bruising on your credit report, meaning you have outstanding collections, current late payments or accounts over limit, then you have a dual priority. Do anything (almost) to avoid another later payment. Bring accounts up to date. Bring amounts borrowed under limit enough that interest charges won’t take them over limit again. Then, when you are ready, contact the collectors and negotiate your way out of any collections as best you can.

I know…. motherhood statements … but sometimes the basics are what works best.

How To Check Your Report For Free

In Canada, Equifax and TransUnion are the two credit rating agencies. Lenders will look at both but Equifax is where they start. Both will provide you a free report by mail if you are prepared to wait the 3-5 weeks for it to show up.

The quicker and more efficient way to is to purchase some form of subscription where you can get it real time online – for a fee.

CreditKarma is a relatively new service in Canada but it provides you real time, free credit reports whenever you want to check it. This has become a very popular service to Canadians. It accesses the TransUnion credit report and provides it to you directly.

One thing to note – the credit scores from any of these sources will be different than the score the mortgage lender uses. The score provided to mortgage lenders is from the licensed scoring algorithm. The score provided to consumers, whether free or subscription service, is from an internal scoring algorithm unique to the credit agency. That way, they avoid paying a third party license fee anytime you want to check your report and score.

Let’s Clear Up Some Confusion

Secondary Credit Cards don’t help your credit. If your spouse is the primary card holder and you have a second card in your name, it won’t show up on your credit report. It won’t help your credit.

Do Both Applicants Need Their Own Established Credit? In short, yes.

You Must Carry a Balance for Best Credit Score. False. Absolutely false. The best scores come from people that have had more than one card, for many years, and carry no balance at all. They use them 2-3 times a year to keep them active. They charge, in total, less than half the limit on the card. These people typically haven’t had a personal or car loan in some time. Use this as a model. Keep your cards active by using a few times a year and otherwise, feel free to deal in cash wherever possible.

Checking My Credit Report Can Hurt My Score. Yes and No. If you start applying often for every credit card deal that comes along, it is going to show up in your score. If you check your own credit report it will have no impact. The scoring algorithm is smart enough to know when it a consumer credit application versus a mortgage application. I could check your score monthly for a whole year and have very little impact on your score. This assumes you continue to pay your bills on time.

Once My Bankruptcy or Consumer Proposal is Paid, I’m Good to Go! Not so much. You need to start to re-build your credit. And for mortgage financing, you will need a minimum 10% down payment in the future. If you have missed one payment after bankruptcy – if you are late just once – then most mortgage lenders will not take a chance on you. Don’t be stuck with private lenders and/or scenarios where you need 35-50% down payment. ** double bankrupts – someone that has gone bankrupt twice – will not get a mortgage from an institutional lender.

Consumer Proposal is Better Than Bankruptcy. From a mortgage lender’s perspective, they are equal. Talk to your trustee about the differences and your best approach if that is your only way out – but for future mortgage applications, it is the same thing.

Once I Have My Mortgage, My Credit Doesn’t Matter. Again, not so much. No lender is obligated to deal with you at the end of your mortgage term. And if you want to switch lenders at renewal, then you basically need to re-qualify at that time. So, credit history and credit scores always matter.

Let’s Wrap This Up

Yes, credit reports and credit scores are where every mortgage lender starts. The key is not to make assumptions. I have had many people worried about their credit only to find out everything is fine. I have had people worried that the hiccup they had as a student – where they screwed up – was going to haunt them. As long as you have managed yourself well since then, it typically isn’t a problem.

TIP ** If you have a child turning 18, get them in to set up a credit card ASAP. It doesn’t have to be big – say $500 or $1000 limit – but start early. Help them develop financial self control and a credit history. A credit card can be a secondary form of non-photo ID. It makes them think about financial responsibility.

This is among the longest post yet. Contact Jim at 519-396-6800 or jimcook@mortgagegroup.com with any questions.